Stock Market

-

The End Of An Era

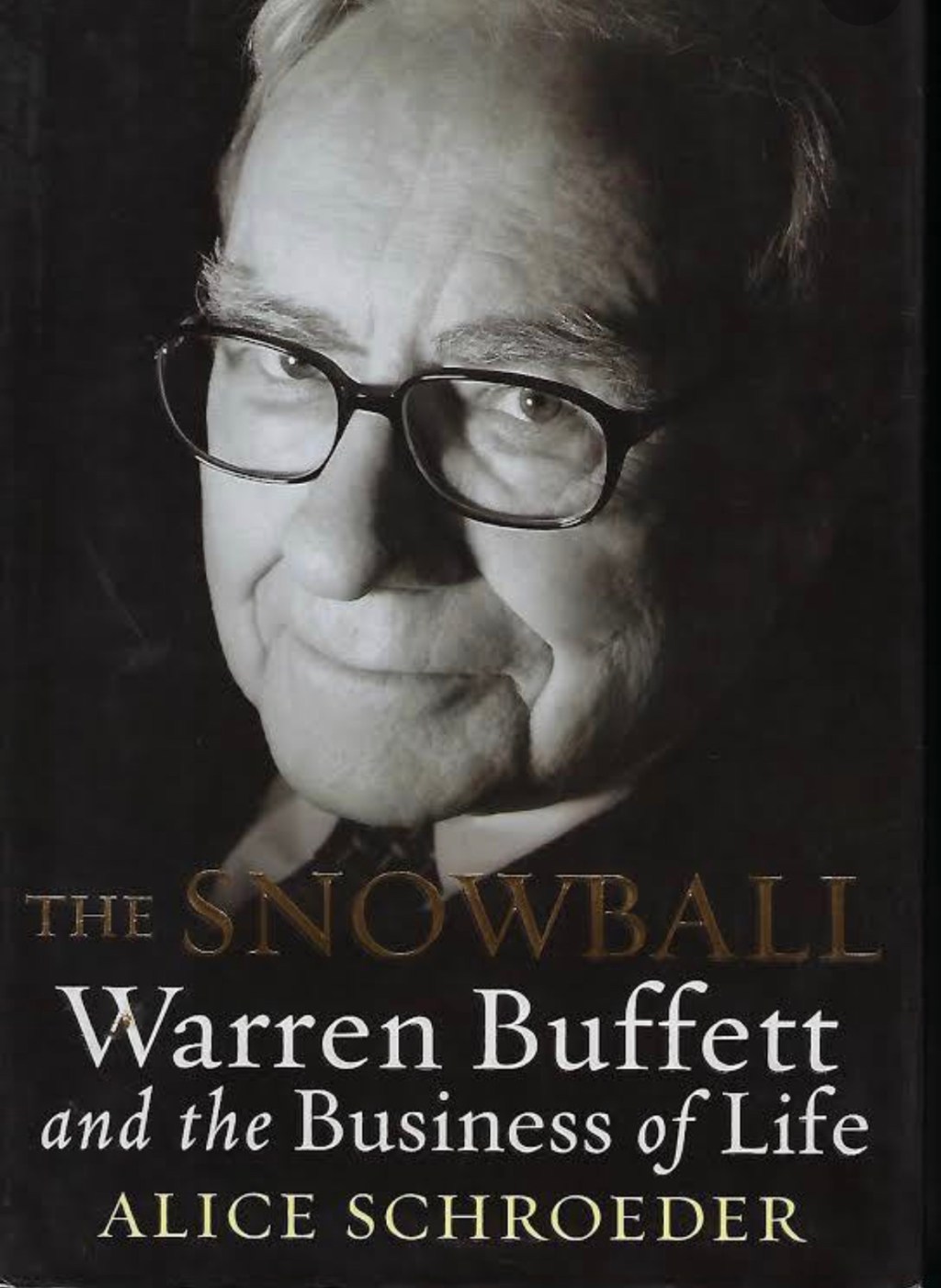

Discovering Warren Buffett’s philosophy through a serendipitous find in a Borders clearance sale transformed my perspective on financial independence. His life and teachings, focusing on humility and discipline, challenge conventional investing wisdom. Continue reading

-

A Masterclass From Warren Buffett

At 94 years old Warren Buffett made the decision to step down as CEO in Jan 2026. He will be remembered as the greatest capitalist of all time. No better time to go out and on top. Continue reading

-

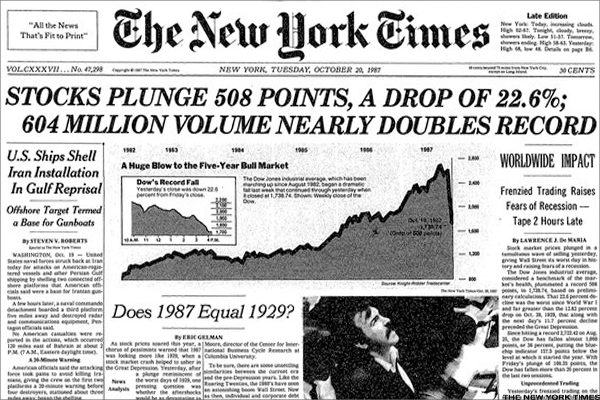

Be Greedy When Others Are Fearful

Emotions and fear are the enemy of the long term investor. Everyone knows that you are supposed to buy low and sell high, but how many are actually able to do it consistently? Very very few. Time in the market always beats timing the market. Continue reading

-

The Book That Changed My Life

Have you ever come across a book that completely upended the paradigm in which you view the world ? Continue reading

-

Are Stocks A Gamble?

If you believe the stock market is a huge casino and fail to invest as a result, you are missing out on the biggest wealth creator the world has ever seen! Continue reading