Intrinsic Value

-

The Book That Changed My Life

Have you ever come across a book that completely upended the paradigm in which you view the world ? Continue reading

-

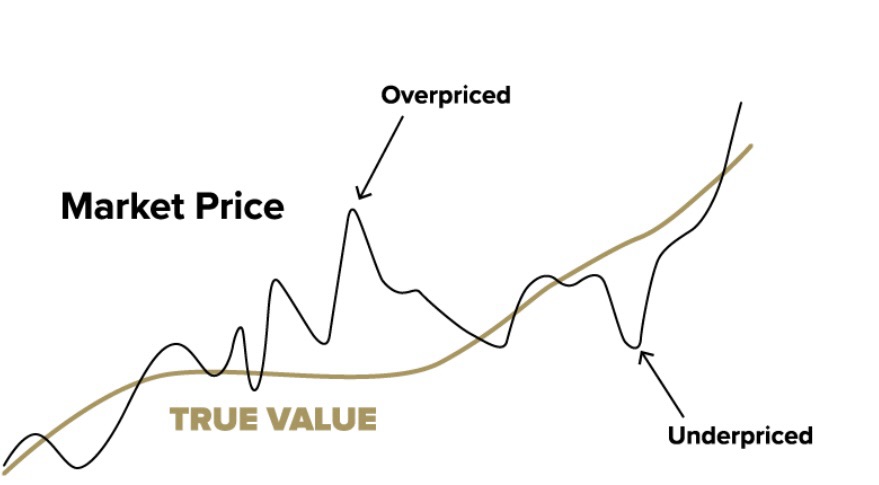

What is Intrinsic Value?

A key component to any investment strategy is understanding what intrinsic value is and how it differs from the market price. Continue reading