financial Freedom

-

How I Decided Not to Buy a Lexus

Purchasing a Lexus might seem appealing, but consider hedonic adaptation and the PERMA pillars to ensure it truly enhances your life’s happiness. Continue reading

-

The Most Dangerous Question In Personal Finance

Are you caught in the trap of living paycheck to paycheck? Discover how shifting from “can we afford it?” to “should we afford it?” can transform your financial future. Continue reading

asset allocation, balance, capital allocation strategy, Cash Flow, cash flow flexibility, financial Freedom, financial planning, financial security, Gap, HYSA, investment strategy, long term investing, Personal Finance, personal growth, savings rate, smart spending, tracking expenses, wealth building -

The End Of An Era

Discovering Warren Buffett’s philosophy through a serendipitous find in a Borders clearance sale transformed my perspective on financial independence. His life and teachings, focusing on humility and discipline, challenge conventional investing wisdom. Continue reading

-

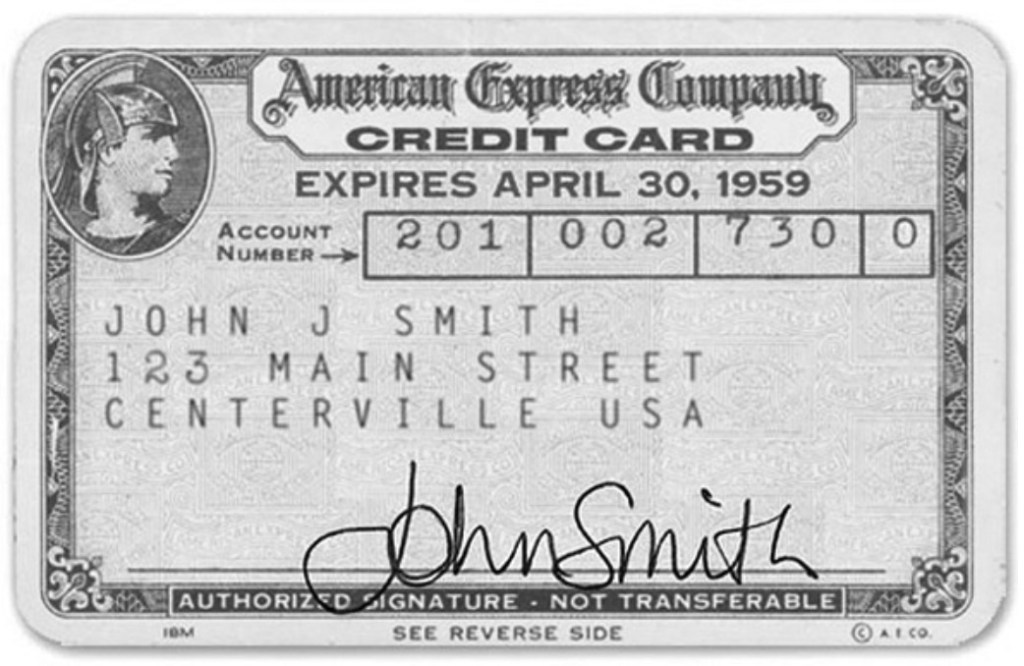

Boujee Travel & 2025 Recap

Using credit cards wisely can be a fantastic way to enjoy amazing travel benefits and even get some money back for the things you love. It’s also a great time at the end of the year to look back on how you used your extra money throughout the year, just to make sure it’s working… Continue reading

-

It’s All About The Expenses..

Making more money is always good. But as we all know, more money will not make you wealthy. Focusing on your expenses is key to getting ahead. Continue reading

-

Be Lazy And Get Rich

Taking the lazy approach to building wealth may very well be the best approach. Continue reading

-

Not Another Blog..

My thoughts on why I started this blog and what I have to offer. Also I offer some insight on how I came up with the name of the site. Continue reading