dollar cost averaging

-

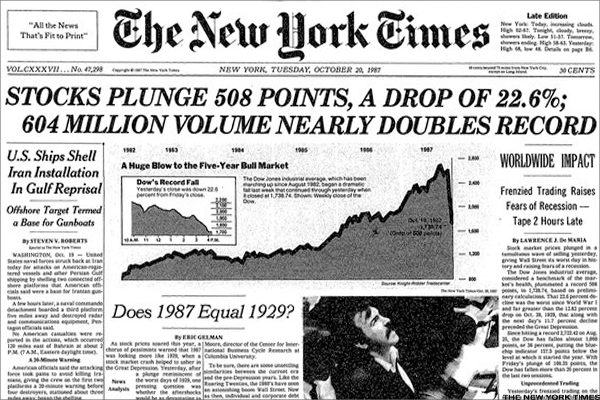

Be Greedy When Others Are Fearful

Emotions and fear are the enemy of the long term investor. Everyone knows that you are supposed to buy low and sell high, but how many are actually able to do it consistently? Very very few. Time in the market always beats timing the market. Continue reading

-

Are Stocks A Gamble?

If you believe the stock market is a huge casino and fail to invest as a result, you are missing out on the biggest wealth creator the world has ever seen! Continue reading