consistency

-

Why I’ve Never Liked Budgeting (And What I Do Instead)

Break free from restrictive budgeting by embracing the gap model. Learn to build wealth and financial security through a new perspective on your finances. Continue reading

-

The End Of An Era

Discovering Warren Buffett’s philosophy through a serendipitous find in a Borders clearance sale transformed my perspective on financial independence. His life and teachings, focusing on humility and discipline, challenge conventional investing wisdom. Continue reading

-

6 Month Check In

I offer up some personal numbers related to cash flow and investing so far for 2025. Continue reading

-

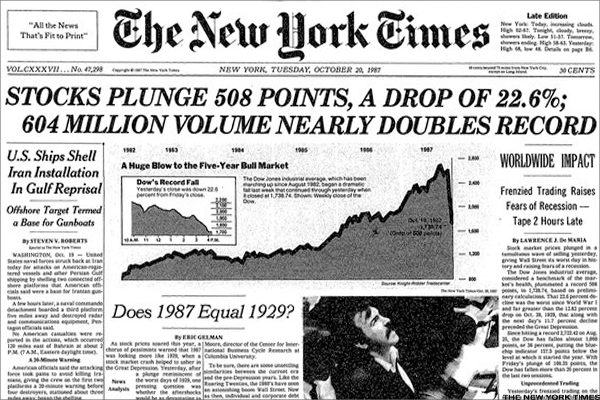

Be Greedy When Others Are Fearful

Emotions and fear are the enemy of the long term investor. Everyone knows that you are supposed to buy low and sell high, but how many are actually able to do it consistently? Very very few. Time in the market always beats timing the market. Continue reading