Compound Interest

-

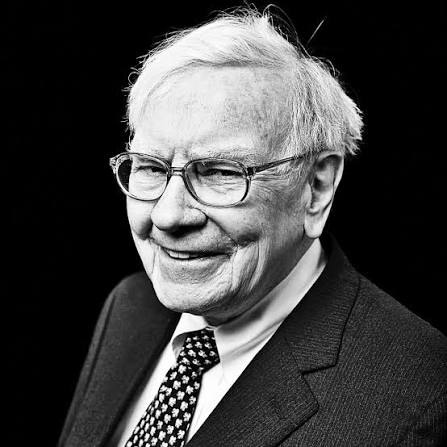

The End Of An Era

Discovering Warren Buffett’s philosophy through a serendipitous find in a Borders clearance sale transformed my perspective on financial independence. His life and teachings, focusing on humility and discipline, challenge conventional investing wisdom. Continue reading

-

6 Month Check In

I offer up some personal numbers related to cash flow and investing so far for 2025. Continue reading

-

Be Lazy And Get Rich

Taking the lazy approach to building wealth may very well be the best approach. Continue reading