Berkshire Hathaway

-

The End Of An Era

Discovering Warren Buffett’s philosophy through a serendipitous find in a Borders clearance sale transformed my perspective on financial independence. His life and teachings, focusing on humility and discipline, challenge conventional investing wisdom. Continue reading

-

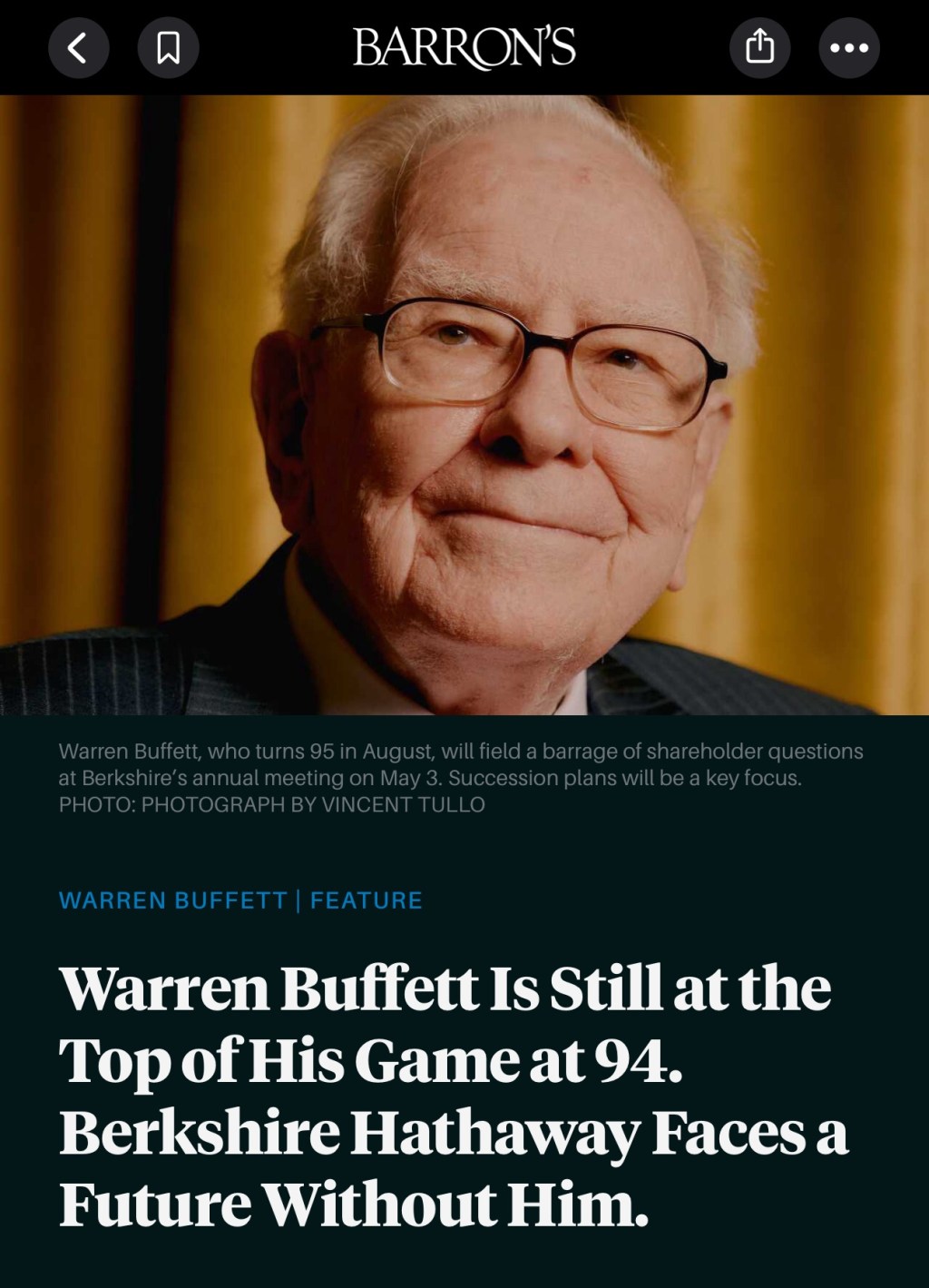

A Masterclass From Warren Buffett

At 94 years old Warren Buffett made the decision to step down as CEO in Jan 2026. He will be remembered as the greatest capitalist of all time. No better time to go out and on top. Continue reading

-

Want To Be Financially Well Off? Be Boring

History shows us time and time again that the best investors are the most boring. In fact, often times the best investment decision are to do nothing and wait. Continue reading