Personal Finance

-

Why I’ve Never Liked Budgeting (And What I Do Instead)

Break free from restrictive budgeting by embracing the gap model. Learn to build wealth and financial security through a new perspective on your finances. Continue reading

-

Boujee Travel & 2025 Recap

Using credit cards wisely can be a fantastic way to enjoy amazing travel benefits and even get some money back for the things you love. It’s also a great time at the end of the year to look back on how you used your extra money throughout the year, just to make sure it’s working… Continue reading

-

6 Month Check In

I offer up some personal numbers related to cash flow and investing so far for 2025. Continue reading

-

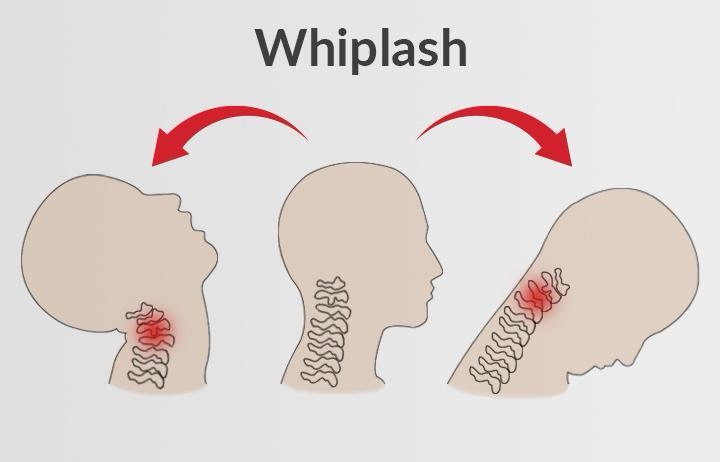

Stock Market Wiplash

What a crazy few weeks in the stock market! I give a crash course on the reasons behind the volatility, plus what I’m doing in response. Continue reading

-

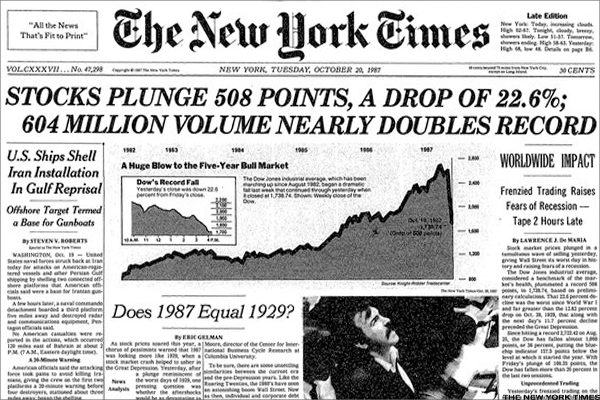

Be Greedy When Others Are Fearful

Emotions and fear are the enemy of the long term investor. Everyone knows that you are supposed to buy low and sell high, but how many are actually able to do it consistently? Very very few. Time in the market always beats timing the market. Continue reading

-

The Ultimate Wealth Score

What is the most important financial formula you can use to know how you are doing financially. I discuss the wealth score, a metric I use that captures what’s important and strips out the fluff. Continue reading

-

Automated Advertisements

Having a personal financial system that is fully automated is a wonderful thing. It frees up mental space to think about cooler things. I use what I call automated advertisements to reassure me throughout my journey that the machine I’ve built is working. Continue reading

-

The Grand 2023 Experiment

Decided to try something different in 2023. Spend more and make less. How did it all work out? Read more and find out! Continue reading

-

It’s All About The Expenses..

Making more money is always good. But as we all know, more money will not make you wealthy. Focusing on your expenses is key to getting ahead. Continue reading

-

The Book That Changed My Life

Have you ever come across a book that completely upended the paradigm in which you view the world ? Continue reading

-

Be Lazy And Get Rich

Taking the lazy approach to building wealth may very well be the best approach. Continue reading

-

Want To Be Financially Well Off? Be Boring

History shows us time and time again that the best investors are the most boring. In fact, often times the best investment decision are to do nothing and wait. Continue reading

-

The Aloe Vera Of Personal Finance

I often get asked, what is the ONE thing I can recommend to help someone with their finances. After hearing a range of problems over the years, my answer is ALWAYS understanding your cash flow. While it certainly isn’t the only thing you should do, it is definitely the first thing and probably the most… Continue reading

-

Are Stocks A Gamble?

If you believe the stock market is a huge casino and fail to invest as a result, you are missing out on the biggest wealth creator the world has ever seen! Continue reading

-

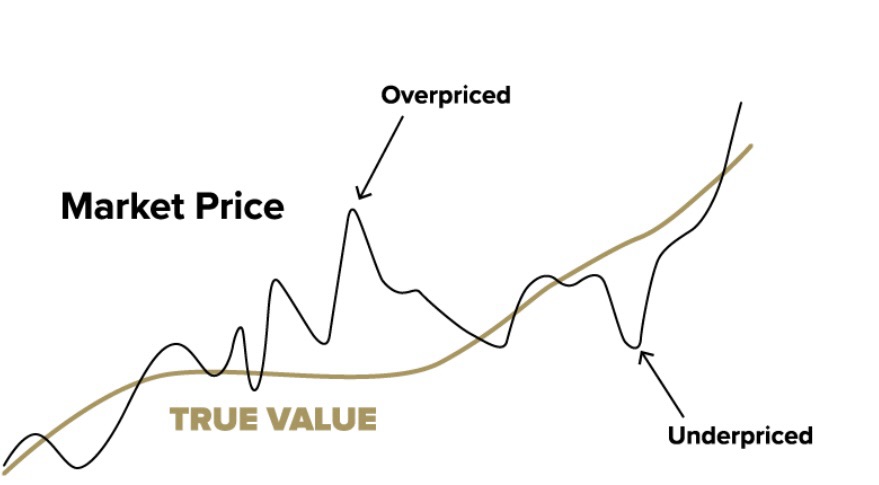

What is Intrinsic Value?

A key component to any investment strategy is understanding what intrinsic value is and how it differs from the market price. Continue reading

-

Not Another Blog..

My thoughts on why I started this blog and what I have to offer. Also I offer some insight on how I came up with the name of the site. Continue reading