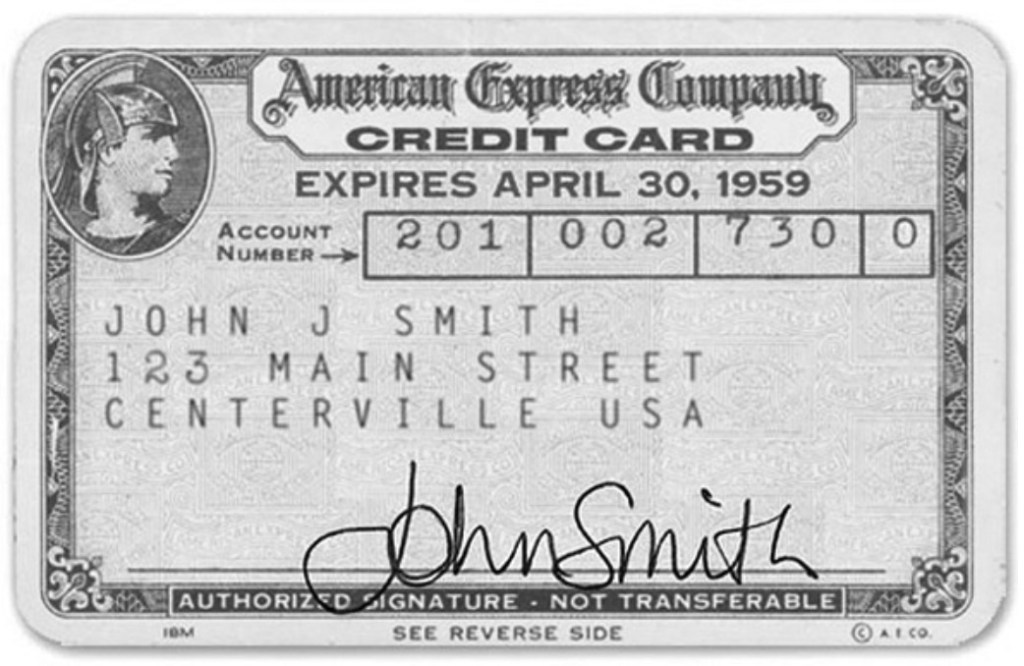

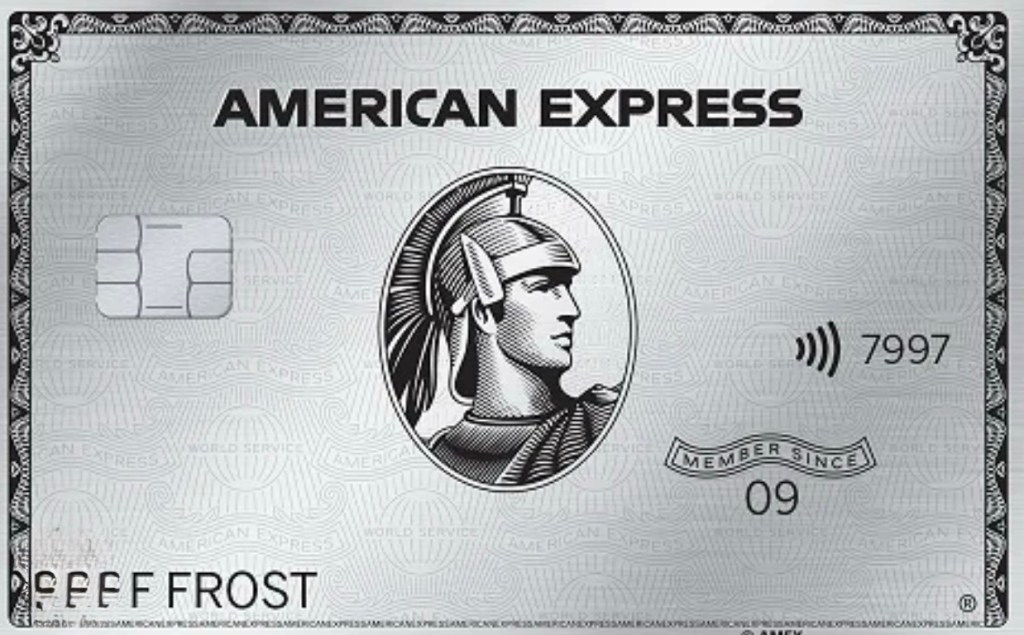

Credit Cards

-

Boujee Travel & 2025 Recap

Using credit cards wisely can be a fantastic way to enjoy amazing travel benefits and even get some money back for the things you love. It’s also a great time at the end of the year to look back on how you used your extra money throughout the year, just to make sure it’s working… Continue reading

-

Free Money Is Everywhere

What’s your credit card reward game like? I share some cool data on my month of November and some pretty epic welcome offers I took advantage of. Continue reading