I decided to upgrade my travel game and get the American Express Platinum card around the end of last year, and I’m so glad I did! The $895 annual fee might seem like a lot, but if you use it wisely, it’s truly amazing.

Amex first debuted the charge card in 1958, and from the beginning it’s been a huge success. There is a certain prestige and exclusivity to the brand in general, due to the stricter standards required to become a “member” as they call it. Having been a member since 2013, I can say unequivocally Amex is an iconic brand with world class customer service.

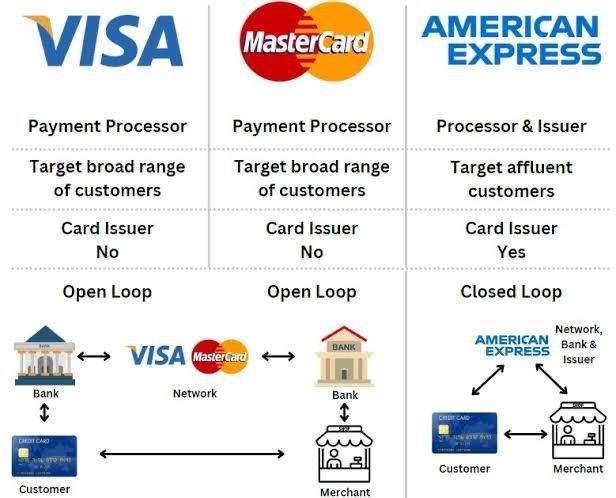

One unique and often overlooked aspect of American Express is the closed loop system they offer. They are both the card issuer and the bank. Whereas other card issuers act more as a toll booth collecting merchant fees on each transaction but not being th bank itself. So Amex tends to have a lot more data on its members, and can really tailor offers that fit your lifestyle. Which is insanely useful.

One thing to keep in mind is that it’s like having a side hustle to get all the card’s perks. Plus, you’ll need to be honest with yourself to see if you’re actually saving money by using the card. For me, I love eating out, flying a few times a year, ordering takeout often, and having a few streaming subscriptions. So, I’d spend money in these areas anyway, which makes the card’s benefits feel real to me. The other perks are just extra goodies. 🎂 Cool. Check that box. So, I’m not really spending $895 to get credits for things I wouldn’t buy normally, which would be a waste. ✅ (I suggest doing a thorough analysis to confirm this.)

My first Amex Platinum travel was pretty cool indeed! I’m likely way behind the common man here in terms of my travel sophistication bonafides, but my simpleton & minimalist mindset means any new stimulus usually triggers maximum dopamine level hits. All this is to say.. I was stoked. It was just a very cool experience. Like a “damn I’ve made it” experience. Definitely over the top statement but also kinda true 🤷♂️

Allow me to take you through my first two travel experiences, so you get an idea of the value.

The Airport Perks

As soon as I received my card, I quickly paid for Global Entry, which includes TSA PreCheck. I also opted for Clear Plus. During the hectic Thanksgiving travel season, navigating security checkpoints was a breeze. I walked right in, skipping a long line, which was quite a treat. I was a bit skeptical about whether this would really make a difference, but on my first try, it definitely saved me at least 30-45 minutes.

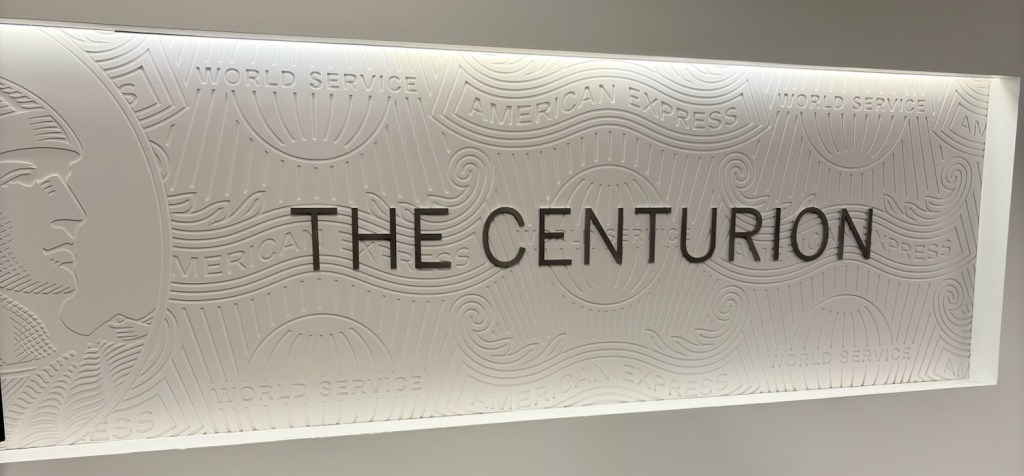

Then, relaxing in the Centurion lounge before my flights completely changed my flying experience.

I usually aim to get to the airport as close to my flight time as I can, but that’s on me. It can be a bit stressful, especially if things like security delays or traffic get in the way. I’ve even had my Garmin watch alert me because my stress was too high while rushing through an airport! So, arriving super early, breezing through security, and then relaxing in the super private and secluded Amex lounge was definitely a treat 😎

At the Houston airport, the Centurion has its own elevator and floor, which is a bit hidden behind the duty-free shops. It felt like I was stepping into a wardrobe from The Lion, The Witch and The Wardrobe, to be honest. I’m not sure if this was intentional or just a practical solution, but it definitely made it feel extra special. It had an open buffet and a fully stocked bar with a premium vibe. Since the airport was so busy, I was half-expecting a long wait, but there wasn’t one. I was in the mood for an ice-cold IPA, and guess what? They had a Christmas Ale on tap! No need to sign anything, no wait, and no fees. I was like, for real? It felt a bit strange, but also incredibly neat. I’m excited to see if it has the same vibe on my next platinum travel adventure, or if it was just because it was new to me. I do get that a new car feel doesn’t last forever. 😔

With Uber Plus & Uber cash, dining credits through the Resy platform, airline credits, hotel credits, and Dunkin credits, this card instantly elevates your travel experience to a whole new level—think VIP treatment! 🤴 Seeing those green reimbursement credits pop up after a trip is like a little reward for your travels.

The Hotel Collection

I recently had the pleasure of staying at my first “The Hotel Collection” resort (THC), and it was a fantastic experience! I was credited back $300 for the room, checked in early (12pm) and checked out late (4pm). Plus I had a $100 room credit!

They even went so far as to fully stock my room as part of Amex package with top shelf snacks! No bootleg snacks, we are talking Hershey bars and Cape Cod chips! I even had to call the front desk to verify I could take them without being billed. They really came in handy at various moments like late at night or early morning before my workout. All in all, another win for the Amex travel experience.

Okay, so here’s the scoop: credit cards can be a bit of a gamble if you’re not careful. But when you use them wisely, they can be a fantastic tool for boosting your finances. In this expensive environment, credit cards can help you save money through cash back, credits, and points. Right now, I’ve got $13,239.41 to play with. And I’ve been using some each year, not like I’m hoarding them.

To get the most out of your credit cards, it’s important to keep a close eye on your spending. Credit card companies understand that many people aren’t using them effectively, aren’t managing their spending well, and often carry over balances. The best use for credit cards is for regular purchases that you can easily pay for. Try to avoid using them for things you can’t afford, and always pay off your balance each month. If you can’t do that, it might be best to steer clear of credit cards, as they can really sink you financially.

2025 Figures

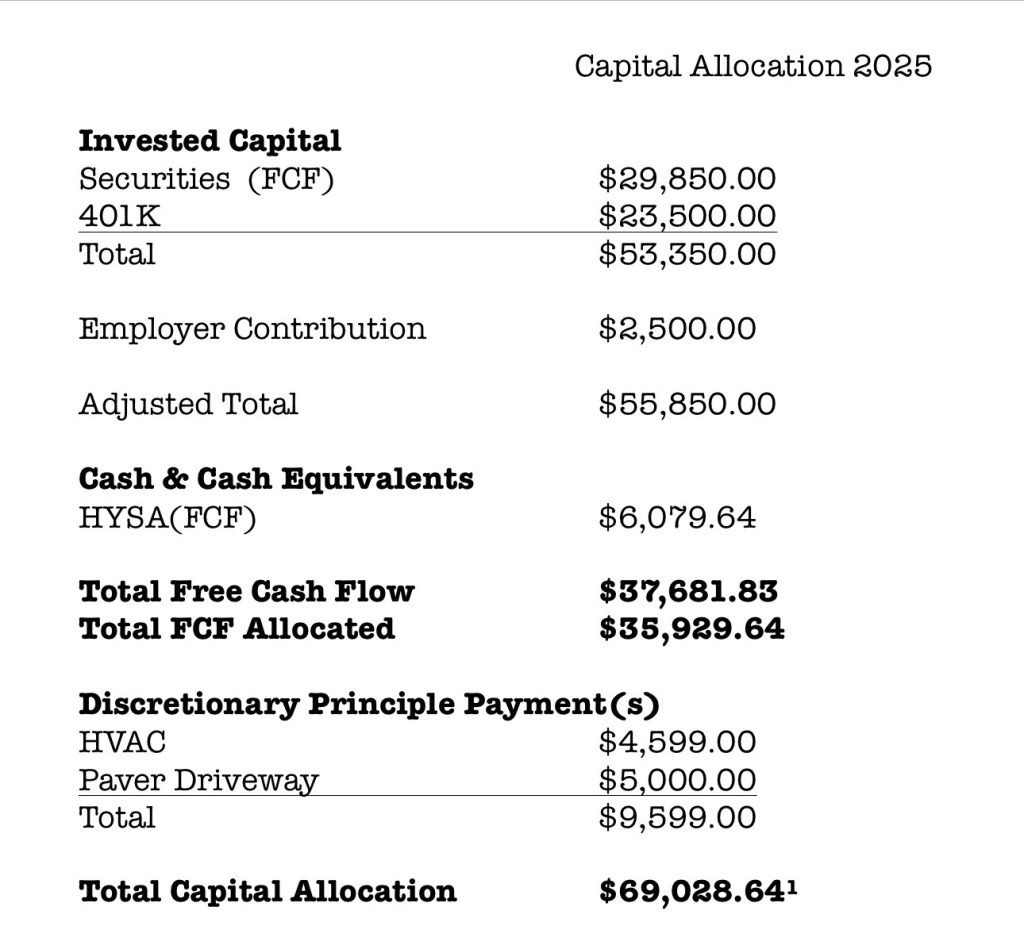

It’s super important to keep track of how you’ve spent your savings, or as we like to call it here, your Gap. The idea is to use these resources to align with your current lifestyle and future financial goals. Striking that balance can feel like solving a puzzle, and it often involves a lot of self-reflection, weighing what you need and want now against what you might need down the road. But having the right information to work with can definitely help make things easier.

I’ve been keeping a personal finance annual report for years, and I always make sure to label one page “Capital Allocation.” This page helps me track exactly how I’ve spent my Gap each year and ensures it matches my goals, whether it’s about my current lifestyle or what I’m aiming to accomplish down the road.

In summary, premium travel credit cards like the American Express Platinum card can really make your travel dreams come true and help you save money all year round. By using cash back, points, and other perks, you can really cut down on the cost of those little luxuries. Just be careful and get a good handle on your money so you don’t overspend or end up with high-interest debt.

After you’ve really mastered understanding your cash flow, maximized your spending with credit card rewards, and elevated your travel, the next step is to take a big picture view of where your money went to ensure it’s working towards your goals.

I hope your 2025 was solid, and happy Gap building in 2026!

Leave a comment