Time to take stock and see what’s what for 2025 so far. With half the year over, it’s as good time as any to check your progress and make sure you are still headed in the right direction for whatever your goals are.

For the year I’ve retained $20,151.25 of free cash flow. From this free cash I’ve purchased $15,566.00 in stocks and transferred $4,000 to a High Yield Savings Account.

On top of the free cash flow that has been allocated, $12,842.00 in pre tax money has gone into the 401k through my employer. So a total retained earnings of $32,993.00 so far for the year.

No debt has been added.

As far as the more balanced approach I’ve been taking to life and money, I’d say that has been going really good. I’m like over 2 years into this new Beau and it’s been interesting to say the least. I find myself having more time for me, friends and family. Which has been pretty cool. Still no regrets for the many years of grinding, but it’s sure nice to take my foot off the gas!

I have been consistently spending what I like to call “just because” money. Sometimes when I do my monthly numbers I find myself kinda shocked how much I spent on stupid random shit.

And when I feel like my work-life balance is out of whack, I will take a few weeks off from any extra shifts and just relax. I usually take overtime only when it’s convenient and decline when it isn’t. I’ve used sick days rather than pushing through like I would have in the past. So long story short, it’s been good.

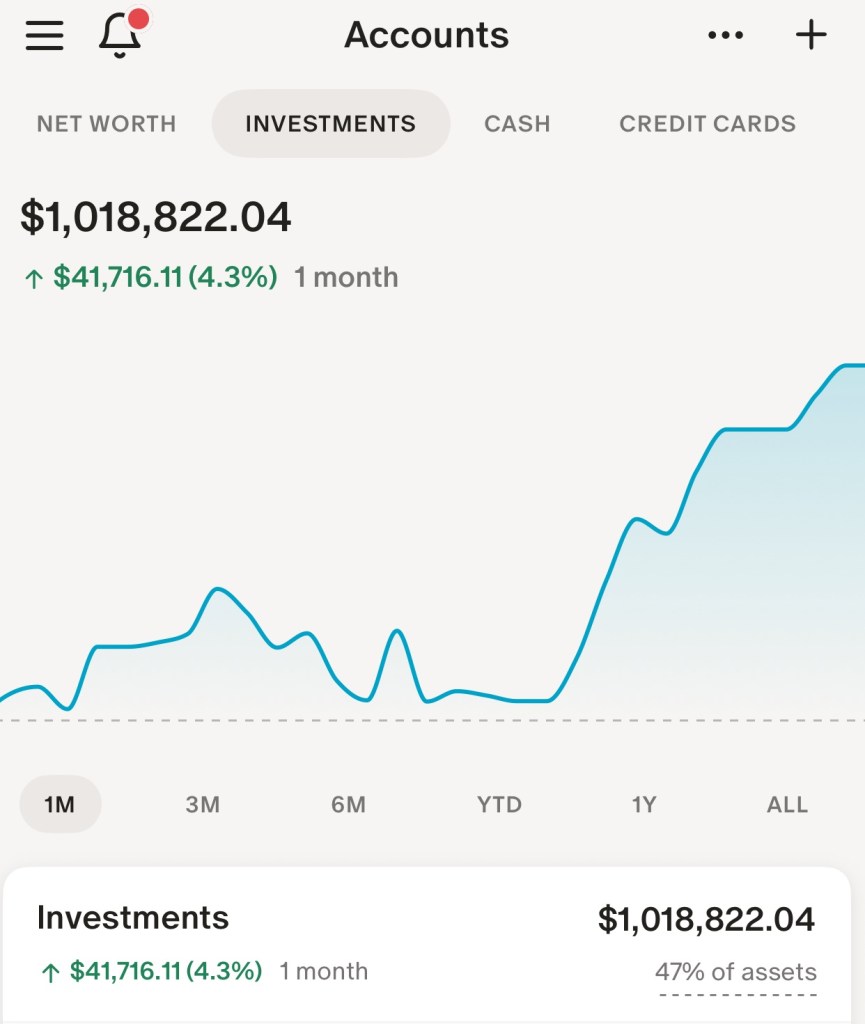

I’m 39, and next month I will turn 40. I started investing when I was the ripe age of 22. I remember going to the Meryl Lynch in Stuart, FL. to open my first IRA account. They declined my money because I didn’t have enough assets. I understood at the time. No hard feelings. But the advisor there told me that I’d have a million dollars by retirement if I started that young and kept at it. I remember thinking that’s kinda crazy and probably not feasible. Well, I’m happy to the report that the million dollar mark has been hit at 39. Needless to say, a celebratory cocktail was had. It should be noted this is just money invested in stocks. Doesn’t include real estate equity or cash.

No special formula or secrets to offer, sorry. Just had a lot of luck, kept my living expenses super cheap and Invested aggressively and consistently. And the rest took care of itself.

Our capital markets are incredible here in the U.S. and we have some of the best companies in the world that are constantly working to increase value for not only their shareholders but their customers. I simply bought into that idea with full confidence.

Hope the year is going good! Maybe next time I write I’ll be the owner of a new Lexus 😬. Keep embracing the grind. Go Dolphins! 🐬

Leave a comment