Warren Buffett is 94 years old. And while he is considered a legend in the investment world for his incredible record over decades, from time to time throughout his career, he has been ridiculed for having lost his way.

In fact, just recently he was criticized for holding too much cash and not making any significant investments or stock repurchases with the massive $338 billion of cash on the balance sheet. This was at the same time stocks powered higher for two back to back years of 20%+ gains.

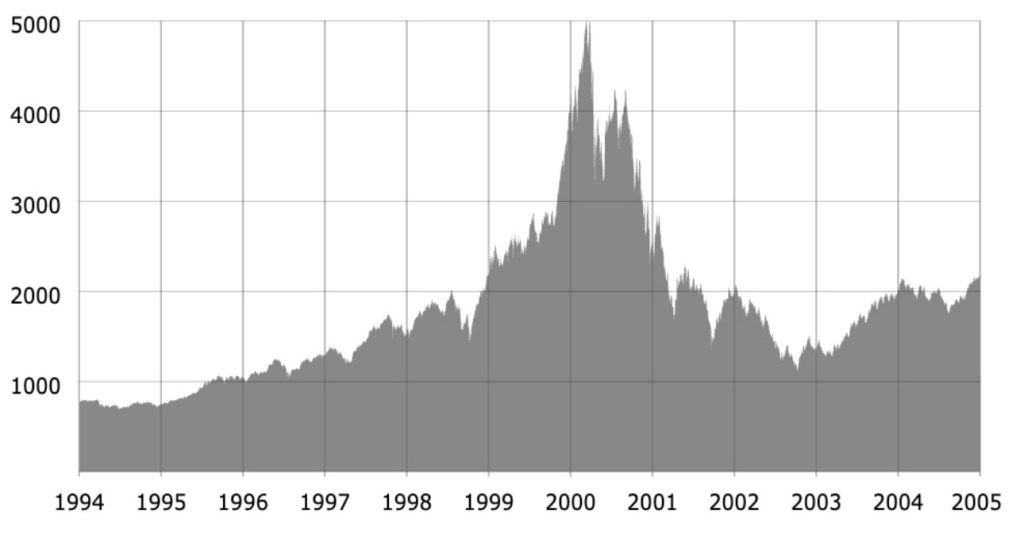

What I see from Buffett today is reminiscent of the famous 1999 speech he gave in Sun Valley in front of the who’s who of business elites that their stocks were over valued and investors should tread carefully. He was openly mocked then just like now. Many said he just didn’t understand technology stocks and he was simply out of touch with the new tech economy.

And of course we all know what happened in the stock market over the next 2-3 years, stocks tanked big time.

On top of not doing much of anything over last couple years while the stock market powered higher, Buffett didn’t even repurchase shares of Berkshire, which is a preferred way to return capital to shareholders. (When you repurchase your own shares, the earnings of the company are spread amongst fewer shares thereby increasing the earnings per share at a higher rate than the actual earnings of the company.)

However, in doing nothing, he showed the world once again why he is the greatest capitalist of all time. And it is really a lesson to us all. Sometimes, doing nothing IS the best move. It’s also the hardest move. When everyone is making huge gains and the money spigot is flowing streams of green, it is incredibly hard to be rational.

Not only did Berkshire not make any significant investments or repurchase their own stock but they sold off big pieces of some companies that they owned, nearly at the peak and slowly built up their cash position. For example, Berkshire sold 2/3 of its massive Apple position amongst other companies in the portfolio for a total of $166 billion dollars.

Recognizing that things looked very expensive Buffett decided that holding cash was THE ultimate flex. Now with these uncertain tariff wars, recession fears and consumer confidence indexes tanking, Berkshire is ready to pounce.

Berkshire has more cash than Apple, Coca Cola, Bank of America and American Express combined.

Clearly Wall Street loves the moves Buffett has made. Currently the year to date performance of the S&P 500 is -3.56% while Berkshire is 16.89%.

All great things must end however. It’s one of the few certainties in life. With that being said, Buffett has decided to step down from the CEO role Jan 1st 2026 after a 60 year career as CEO. He has put the company in an envious position. What Warren Buffett did in business will likely never be replicated again. It was the perfect combination of brilliance/focus, market conditions and timing. $100 dollars invested in Berkshire Hathaway in 1965 would be worth roughly $5.5 million today.

When I first learned he was stepping down I just had to smile. What a fantastic end to a legendary career. Going out on top.

Leave a comment