I like to think I’m 100% bullish and long term with regard to U.S. stocks. But when you lose $141,500 in a matter of a month and a half, a little financial self reflection is only natural.

Don’t get me wrong, I love volatility for the simple reason I’m able to purchase quality companies at a cheaper price. And of course corrections and bear markets are par for the course with regard to long term stock ownership. But what we witnessed last week….was Different. Dare I use the phrase most abhorred on Wall Street “this time is different.”

It was a violent crash that was all but surely self inflicted. In a matter of two days after April 2nd which was dubbed “Liberation day” by the current administration, stocks lost over 10%. This was two of the worst days on Wall Street since the early days of Covid. The bloodshed continued until the 9th when we had one of the single best days on Wall Street with stocks roaring up 9.5% on the announcement by the Trump administration that there will be a 90 day pause on all retaliatory tariffs above the baseline 10% that was implemented.

The stock market volatility surely got the presidents attention, but what really got his attention was the sudden and massive overnight selling of Treasuries by both the hedge fund community and foreign investors. This is a huge problem. Treasures should be thought of as a safe place to turn to in highly volatile times. In fact, they are referred to as a safe haven asset. The fact that they saw their biggest overnight decline since 1982 was the financial equivalent to “Houston, we have a problem.” Confidence in our markets had crashed. Pushing up interest rates drastically overnight.

This is a major problem for consumers who want to borrow, but also for the government who has to pay interest on those Treasuries. Needless to say, this was pushing our economy to a cliff with a drop off of 2007 Great Recession proportions.

I won’t get into the politics of what is happening. Suffice it to say, dealing with a $1.2 trillion dollar trade deficit is no easy task. $294 billion of which is from China alone. Make no mistake, although not a huge priority for the American public, this is a huge and growing problem.

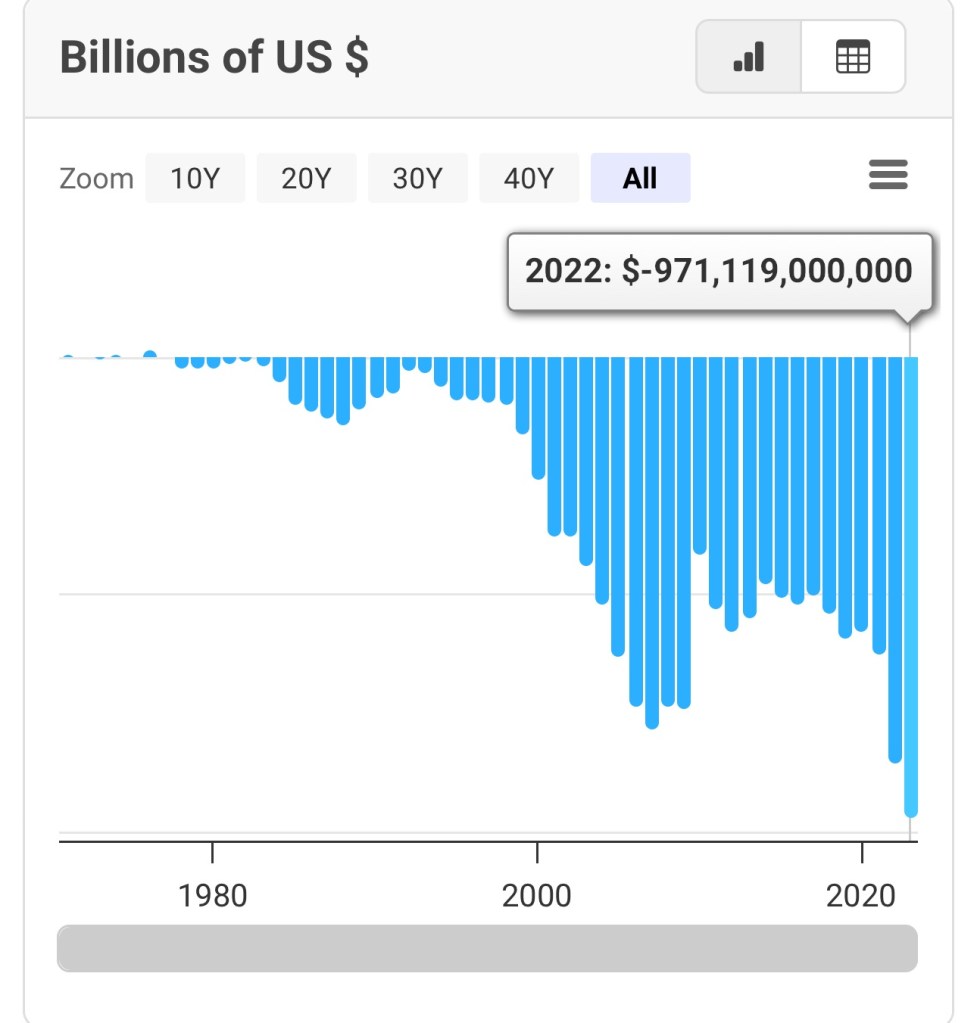

Imagine for a second being an incredibly wealthy and successful farmer. You produce everything you need and then some. This success can make one feel entitled to a lifestyle that is beyond the scope of what one can reasonably afford. So you start to purchase luxuries from others in town. Expanding your lifestyle as much as you can. Since you can’t really afford these items, you simply give up small pieces of ownership of your farm. Slowly eroding your control. When we run a trade deficit, we don’t actually have the money to pay for that. So we issue IOU’s from the government. Usually this is the form of U.S. Treasuries but it can also be real estate or any number of assets. Our trade deficit as I mentioned is $1.2 trillion dollars and is equal to 3.9% of our GDP. GDP is the value of all goods and services produced. This deficit has been negative and growing since 1977 as illustrated here:

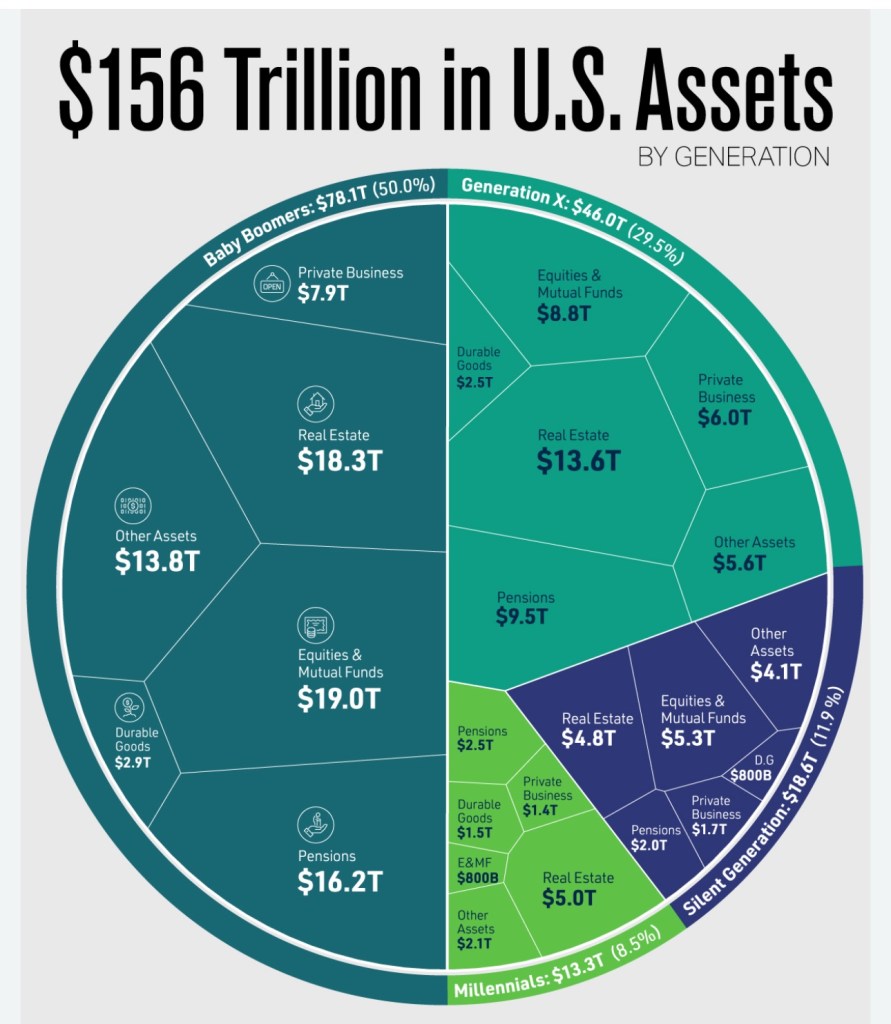

Currently the entire accumulated wealth of our country from both private citizens and businesses is roughly $156 trillion dollars and we have $8.5 of that is held outside of the U.S. Just like the farmer who consumes way more than he can produce and sells off portions of his or her farm, America is slowly selling and mortgaging off its wealth to others.

Like debates there are two sides to every argument. We can afford to over consume and run deficits because we are an incredibly wealthy country. We have only 4.2% of the world population yet produce 26.4% of the world’s GDP. And allowing smaller countries around the world to “take advantage” of us in trade is much the same way that children mooch off their parents for a while until they become contributing members of society. As a parent you want to see your kids do well, I hope. You know that if you produce successful children who contribute things to society, the world is a better and more prosperous place for everyone.

As I mentioned earlier, China is the source of our largest trade deficit. And although this is not great, it has benefits. For one, we have had an Influx of cheap goods which has kept inflation low for 20 plus years. Also, we have a very large and rich country to sell stuff to that didn’t exist 70 years ago. You think Coca-Cola or McDonald’s cared about the Chinese market 50 years ago? Now it’s likely the fastest growing part of their businesses.

But with that good there are repercussions. Mainly the loss of the manufacturing jobs across many of our cities and the transfer of wealth to other nations. As you can see this is a complex problem. This is a globalized economy with supply chains all over the world. Throwing a grenade in the middle of it will likely produce more weeks like we just had if it persists.

My response is to do very little. In the months leading up to Inauguration Day I had anticipated some turbulence in markets based on what was being proposed. And I also thought stocks as a whole were pretty expensive. Take Warren Buffett’s Berkshire Hathaway, which happens to be my largest holding. They have a record $340 billion give or take of cash that isn’t being invested. That should tell you something. So, I too built a 1.5-2% cash position. I also have 30% of my money split between international stocks and short term bonds. So I haven’t been hit as hard as a 100% U.S. portfolio.

I have used some of my cash to purchase stocks after this recent pullback. After all, be “greedy when others are fearful.” And, since my international and short term bond portion has not gone down as much, I did a rebalance on my portfolio which sold some international stocks and bonds and purchased U.S. stocks, after the pullback. I figure at least I’m doing something during this crazy time. Stocks will very likely be worth more 10-20 years from now so drastic panic selling and exiting stocks isn’t necessary for the long term investor. But the few little things I DID DO at least make me feel like I’m doing something. Going forward I haven’t decided to continue building up cash or investing. I suppose I will watch carefully and see where the dust settles. Happy Investing!

Leave a comment