Wall Street is a crazy place. The minute you think you have it figured, it will inevitably prove you a fool. The famous phrase of bulls, bears and bum steers is parlance for the emotional roller coaster that exists on the street.

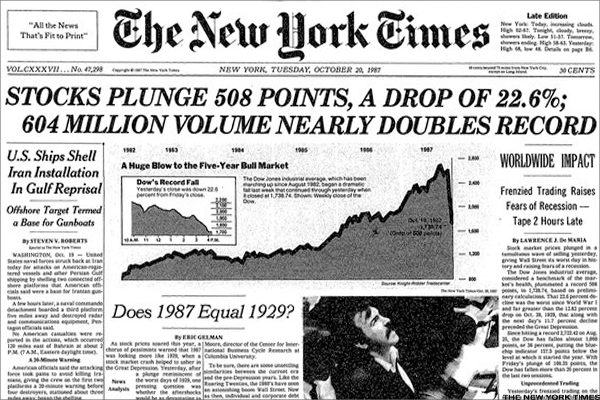

The post image above is a famous stock market crash called Black Monday and it happened October 19, 1987. In fact, it was one of the single worst days on Wall Street. Of course, if you’ve been around long enough you likely will recall many bad periods in the stock market. With all this doom, what is one to do? Say the hell with the market and park your savings in cash? First, let’s take a look at how stocks did in the year 1987 and thereafter. S&P Returns (with dividend reinvestment):

- 1987 5.1%

- 1988 16.1%

- 1989 31.7%

Now to more current events..

What do you suppose the mood was like year end 2022 across the country and in particular on Wall Street? Inflation was high, coming in at 9.1% in June of 2022 on an annualized basis. This caused the Federal Reserve to begin one of the fastest rate tightening cycles in its history. They raised the federal funds rate by more than 500 basis points (5%) between March 2022 and July 2022. For consumers and governments with large debt balances, this was a shock. All of a sudden, in addition to the rapid rise in housing, food and consumer items, servicing debt just got suddenly much more expensive. To say the mood was sour is an understatement to say the least. All of this collectively sent stocks into a tailspin.

Like it or not. Fear and emotions get the best of us when it comes to money. Even the best investors of our time can fall victim to it. Realizing these flaws, how do we counter it? We just keep buying and keeping the right perspective. That’s the answer. Let’s say you bought a farm for 500k. Your intention was to hold it for a long time. What would be your biggest concern? How much it earns each year relative to what you paid is the most logical answer. If prevailing interest rates were 3-5% as they currently are and your investment was producing 50-75k of earnings each year, that’s a perfectly solid investment. You’d need not pay attention to overly optimistic or pessimistic buyers and what they’d offer you for your farm. Hopefully over time with efficiency gains and crop price increases you can grow the earnings and improve the return on equity. The year to year valuations, no matter how positive or negative, need not concern you.

With the sermon out of the way, what did I do differently following the horrible stock market of 2022? Absolutely nothing. Sure I noticed my account balance took a slashing. But I understood why it happened. I know from reading that corporate profits were still excellent. Returns on equity across Wall Street were excellent as well. So I just kept buying. Here is my total stock market purchases for 2022 and beyond:

- 2022 $36,043

- 2023 $31,000

- 2024 $50,000

2022 and 2023 were a bit slower from an investing standpoint due to three roof purchases and a new car, not out of fear. Surely if I had more capital I’d have invested more. So how did this stay the course approach workout you may be wondering?

In case you missed it, these are two front page articles of the Wall Street journal, both the last day of the year, two years apart. My how fast things can change. Admittedly, this was a rather fast turn around in the world of stocks. In fact, we have seen many periods just like this since the 2008 Great Recession. Huge price corrections followed shortly thereafter by record highs. In fact, this has become such a thing, it has its own phrase: BTD (buy the dip).

It’s probably important to note that this isn’t always the case with the stock market. We’ve become immured by a market that seems to do nothing but go up for the better part of 15-16 years. I get the feeling an unshakable confidence is stewing. You see offsets from this confidence boiling over into meme stocks and crypto currencies. After all, it’s been a long bull market with only brief corrections in between. But remember, Wall Street is a humbling place.

Let’s recall two 17 year periods from 1964-1981 and then 1981-1998. These two periods are such a fascinating case study of Wall Street. The mood towards stocks after WW2 and the Great Depression was not good. It didn’t help that profit margins across corporate America were depressed by the early 80’s thanks to the sledgehammer on the economy from the Fed Chairman Paul Volcker raising interest rates rapidly to cool inflation. This interest rate tightening cycle also acted like a noose to stocks. Yet the economy as a whole was absolutely booming. In fact, GDP during this first 17 year period rose 373%. Still, stocks were unfashionable. As a result, bargains were everywhere. Warren Buffett was famously quoted as saying that living in this era was like being “a sex crazed teenager living in a harem.” But people just did not want to own stocks.

In the period 1981-1998, interest rates dropped from a high of 13.65% to 5.09%. And GDP increased a respectable 177%. Yet business sentiment improved significantly even though the economy wasn’t any materially better than the previous 17 year period. Below is the stock market performance for the two periods.

December 31, 1964: 874.12

December 31, 1981: 875

December 31, 1981: 875

December 31, 1998: 9181.43

Bull markets, bear markets. Doesn’t matter. Keep your wits about you, keep disciplined and keep investing. Betting against America has never worked. Even long periods of awfulness eventually produce satisfactory results to the long term, consistent and patient investor.

Leave a comment