I love stocks. Anyone that knows me knows this. It’s a true and natural love. Unconditional. The reason for this, 1) I view them as owning a piece of American business. 2) I recognize that they will be the gift that keeps on giving. 3) It is really a lazy asset class, meaning I don’t need to do anything and 4) I don’t need to know anything either. You may be wondering how can that be? You don’t need to do or know anything?! Yes. That’s the magic of the stock market. In fact, I often make the case that this is why they are my favorite asset class. I can let the best CEO’s in the world run them and I can just sit back and enjoy the ride. What you need it discipline to keep buying. And to be educated on want you really own. This education should breed confidence. So I guess I lied a tad. But you can certainly get all the education you will need to be successful from this blog. Anything more is probably unnecessary.

Owning a stock is very much like being a silent partner in a company. The company needed your capital to grow. In exchange for your capital, you are a part owner. If you picked a solid company, earnings should grow over time. And so too will the value of your share or shares. The best part is you get to let someone else run the business. That’s not your job. You are a capitalist after all.

But let’s be real, picking stocks takes skill. You need to understand accounting, read financial statements and have a pretty good sense of the difference between price and value. So how can I get away with saying you don’t need to do anything or know anything? Index funds. All you have to do to be wealthy is buy a Total Market Index Fund, every month. You don’t have to know how to time the market. You don’t need to know which stocks to pick. You don’t need to know when to sell either. And you damn sure don’t need to study accounting. You simply manage your personal cash flow, take the excess each month, and buy stocks. Easy peasy. It’s that simple. Admittedly this does take a level of discipline. Living below your means that is. But hey, nothing worth having is without some element of sacrifice. And would you really cherish the accomplishment later without said sacrifice? Probably not! So buckle down and double down!

We all live hectic lives with our careers, children if you have them and maintaining households. For most people, setting themselves up financially is an after thought. Where do I even begin? It’s all to complicated and risky. And thats why stocks are so amazing. With a simple click of the mouse, or even automatically, you can buy a cross section of American business. Best of all, the best CEO’s in the world will be working hard each and every day to increase the value of your shares. You can have this running in the background. Taking on a life of its own. Making you rich without you even knowing it. In fact, if you never checked it, it would probably be to your advantage!

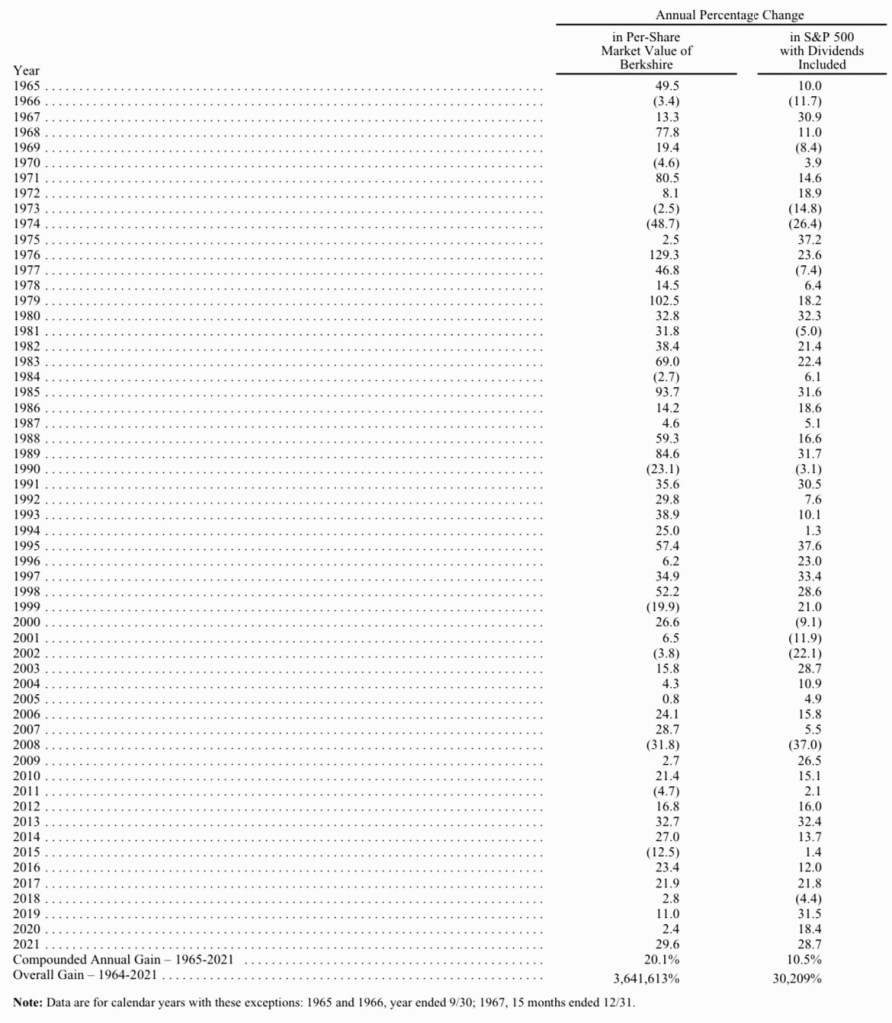

I like to think of someone’s investing career as 40 years. From 20 years old to 60 generally. With that, I’d like to show two different photos. The first one is the returns of the S&P 500 since 1965. The second is the value of your portfolio if you Invested $12,000 a year from age 20 to 60, with a compound interest rate of 10.5%, which is what the market has done since 1965 on average according to the first photo. Sometimes, being lazy is the right move.

Leave a comment