I often get asked, what is the ONE thing I can recommend to help someone with their finances. After hearing a range of problems over the years, my answer is ALWAYS understanding your cash flow. While it certainly isn’t the only thing you should do, it is definitely the first thing and probably the most important. Cash flow is to personal finance as aloe vera is to basically all ailments, being nature’s most powerful natural healer. As such, all problems with money start and end with cash flow. It’s true if you are talking personal finance or business and investments. Understanding the relationship between cash coming in and cash going out is foundational. This cannot bet skipped or done half ass.

So how do you start tracking your cash flow? Brace yourself… keep every receipt or somehow record what you spend money on! And this is your total spending not just your bills. If you give someone a quarter, record it! Ha! No but seriously. It needs to be dead on balls accurate (My Cousin Vinny reference) for you to have confidence in your monthly figures. I also categorize things I’d like to track. For example, food, gas, miscellaneous, entertainment, travel & gifts. This embraces that old adage of what you keep track of you naturally improve. And by improve I mean get more efficient in your spending. Cutting waste, and determining what is truly important and what isn’t. And how that spending is fitting into your long term financial goals.

When I started out I decided that there was a ton of ridiculous Americanized fancy pancy wasteful spending going on. Things that added no lasting value and or happiness to my life. We get sucked into this idea that we work hard. And spending money on things is a natural byproduct of this and we deserve it like a birth right. I was a bit extreme with this early on. I basically didn’t buy anything I “wanted” for years. I bought things I needed of course, like new running shoes yearly, and other things like that. But never just because I wanted it. As I get older and I’ve accomplished some goals financially, i’ve learned it’s ok to every now and then buy a want. Especially if it has lasting value. I recently bought TWO pair of Oakley sunglasses. One for casual every day wear and boating and one mainly for running and outdoor fitness. But these are things I will use every day for a long time. And I have to say they were well worth the money. I love running in them.

I think the key with “want” spending is to avoid impulsivity. Also to scrutinize your spending to see if it improves your life, has lasting value and adds happiness for long periods of time. Avoid the sugar high spikes off happiness that impulse shopping provides.

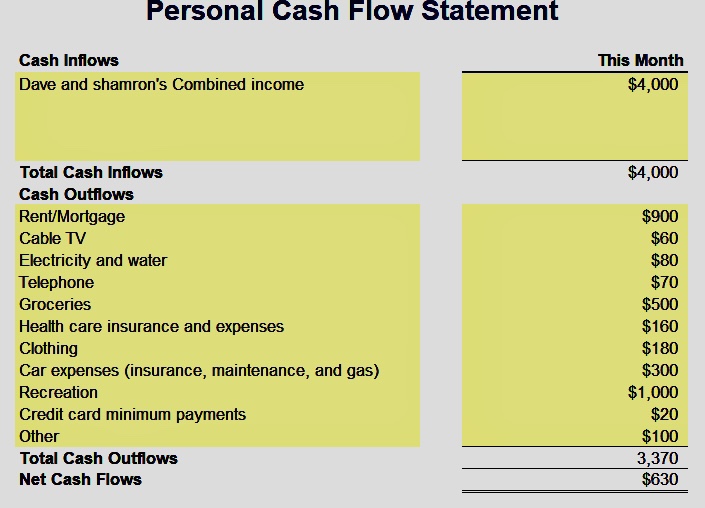

Ok ok ok, this all sounds simple and easy. If it were that easy then why doesn’t everyone do it? This question is one I think about often. And I don’t really know. If I told you all you had to do was rub aloe on your arm every night before bed and you’d be healthy forever, everyone would do it. Tell people to keep a record of every penny earned and spent and they look at you like you have two heads. The following is an example..

Sometimes I think people doubt I actually do that every month. I suppose it is a lot to do at first. That is until you get used to it. I’ve been doing that for over a decade actually. Month after month. My job is to make sure I have more money come in than go out. And I will do whatever I have to, to make sure of that. It’s that simple.

When I tell people this they start blurting out estimates and ranges. “I spend about 650 on food and 300 on gifts” etc. This is it NOT going to work.

You need to have full accountability. Like you were running a business. Imagine. If every month and therefore every year you knew exactly where all your money went. To the penny. Even more important, you knew how much you spent relative to how much you made. How empowered and in control you would be! The secret to getting ahead is to build the gap between the income and the expenses. And then take that gap and set yourself up financially. But there has to be a gap. Month in and month out. The only way to be sure of this is to keep track. Otherwise you will naturally start to say crazy things like we can afford this that and a third. Spending all the way up to your income. And then the gap is gone. You are now treading water financially.

Do your current and future self a solid and build your gap between income and expenses. Do this by keeping track of your expenses like a religion. Your life will take so many positive steps forward and it will be so much easier. You will be in full control of your finances. Done right and you will have thousands in extra cash every month to pay down debt and later invest. You will be stunned how powerful this is over time. How simple your financial life can be.

Let me give you an example from my own personal situation that will demonstrate how powerful knowing your cash flow is. I have three homes. Two single family rental properties and my primary home. I just replaced all three roofs with 5V Metal. Total cost was $49,040. I don’t have that kind of cash sitting around. Strategically. Better to have it invested. But, I have two lines of credit at low rates. A Home Equity Line of Credit & a credit line against my brokerage account. Both are variable rates. But much lower than a credit card because they are collateralized. In fact, they are cheaper than a mortgage currently. Now using this kind of debt may seem daunting. Admittedly I had anxiety at first as well. But then I realized how much data I have to analyze to determine my expected pay off time. And this alleviated my worry.

I averaged out my free cash flow over the past two years. $4,372 a month is what I averaged, after of course maxing out my 401k. So while still contributing the most I can to my retirement, I still had plenty of cash each year to work with. Suddenly this became an 11 month problem. ($49,040/4,372=11). Ahhhhh the power of knowing what you spend. Been sleeping like a baby every since. And! Now my biggest capital expense at each property is complete. Should be smooth sailing from here.

Now imagine if I was barely squeaking by each month, spending right up to what I made with no accountability and no free cash. I’d be very discouraged and this would be a mounting problem.

Unfortunately, If you don’t have full accountability, you will spend most of what you bring in or possibly even more than you bring in. Cash will dwindle down, forcing you to use credit, refinance your house, take from retirement accounts or even borrow from others when expensive things happen. Imagine a life where you have $8,500 a month coming in on average and $2,500 being spent. This is equivalent to financial angel handing you $6,000 solely to put aside to build your financial empire. Your life expenses have been paid from the $2,500.

Only thing is, it HAS to be used to build your financial future. For example, to pay off debts, build college funds for your children, pay off your house or cars etc. and hopefully build assets once the debt is cleared up. If you start to squander it on useless consumer items the angel takes this “future” building money away. The debt comes back slowly and you backtrack. Fortunately, you don’t need an angel, at least not in this context. You just need to understand how much you spend relative to how much you make.

Leave a comment