The personal finance space is vast and overwhelming. Everyone would love to be financially secure, but where do you start? What is the secret to getting ahead? Are there a few simple action steps you can do now that pay huge dividends throughout your life? See what I did there? you’re welcome.

Much like investing my money and ultimately seeking a satisfactory return, I like action steps that require little upfront time yet provide a windfall of lifelong benefit returns. Think of this as a personal finance hack. It’s so simple yet almost nobody outside of personal finance nerds such as myself actually do it. But this is to good not to share. What is this life altering free hack? Know what you spend money on. Boom. Done. Ok ok, I’ll elaborate.

When I say “know what you spend money on” I don’t mean tell me your bills such as your mortgage, cell phone and your utility cost. Everyone knows their bills almost to the penny, and that’s good too. But the real value comes from knowing your total spend. For example, food, gas, random trips to target, gifts, travel or even random vending machine purchases etc. Every penny is key. Looking at your bills and all your discretionary spending together gives you what your total monthly expenses are. This is key. So why is this such a big deal? With this data you can answer so many questions about the past and future. Suddenly things are crystal clear. This clarity brings a sense of calm and focus. Let’s talk about the benefits.

Perspective If you’ve been struggling financially, which let’s face it, a lot of people are the days, having accurate data on where your money is going helps to have perspective. You may be thinking, who the hell cares about perspective when you are broke?! Stay with me, it will be worth it. Take a second to write down what you think you spend a month on your total food costs. Not just groceries but take out, restaurants and anything else that you would classify as “food.” Then try keeping receipts for a month for all these food items. Try to be as accurate as possible. I’m willing to bet your actual spending on this category will shock you. Now let’s take it one step further and keep every single receipt for a full month on every purchase you make. Again, this number may shock you. Little mindless purchases add up to big spending over a 31 day period believe me. Once every penny is accounted for, next let’s compare it to your total take home pay for the same month. If done correctly you should have a very accurate bird’s eye view of where your money is going and what is left after all the spending has happened.

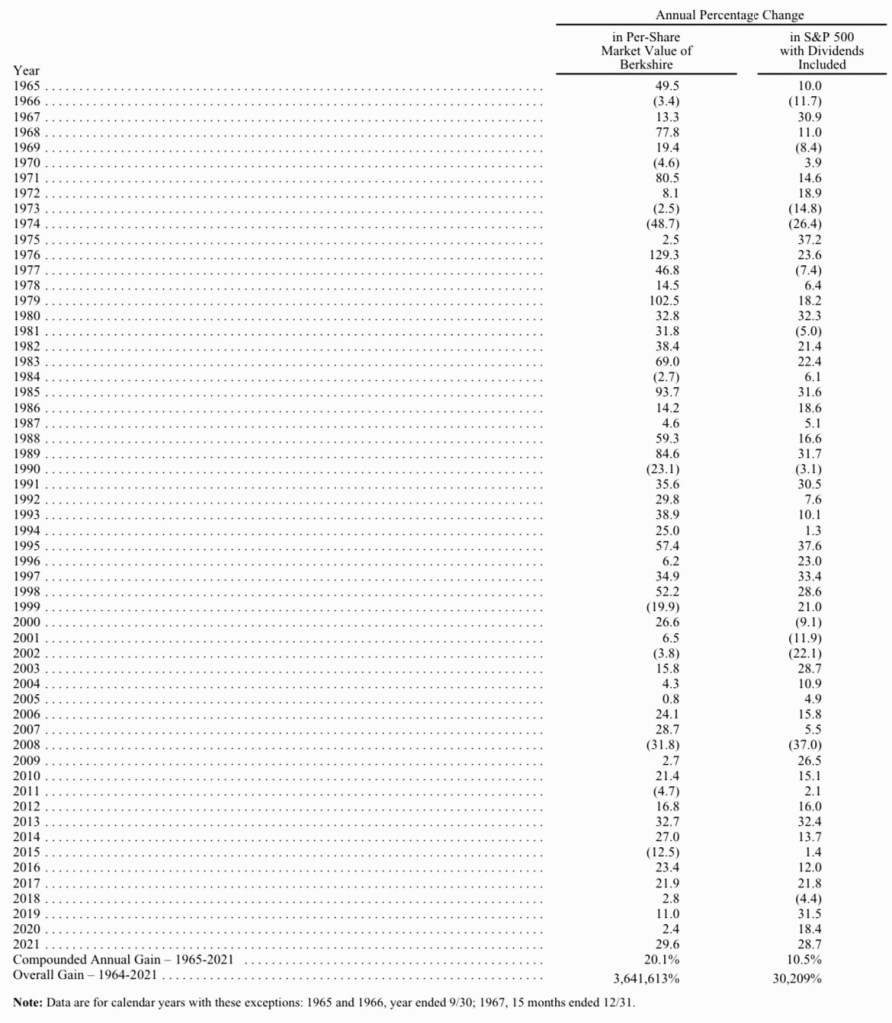

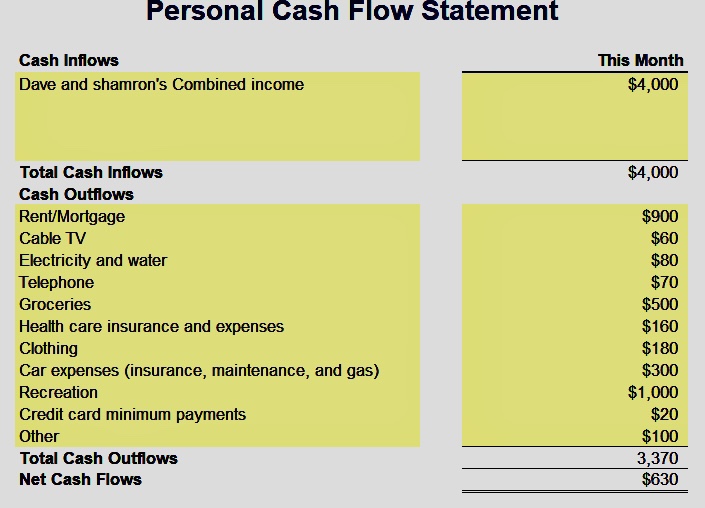

Now that you can visually see where your money went, start scrutinizing what was wasteful or excessive. If your total spend was very close to your take home pay, then this is a problem. I call this treading water. Yea you are staying afloat, but you aren’t going anywhere. And if you catch a cramp, you are toast. The title of this blog is Build The Gap. The gap meaning the difference between your income and total expenses. Some would call this free cash flow. It’s considered free because you can do whatever you like with it. If you keep track of spending accurately, then you should know your gap each month.

Now a little perspective. Spending $600 a month for a family on restaurants for an entire month may not seem excessive. Hell in todays world this may be 2-3 dinners only. But If you consistently have no gap or even negative gap, meaning more expenses than income, suddenly these dinners seem more outrageous. On the flip side if you have consistent gap, in line with your financial and lifestyle goals, then $600 is money well spent. How would you know this insight If you didn’t keep track? The answer is you wouldn’t. Operating your budget on hopes and prayers is like treading water in the middle of the ocean. Sure with the salinity in the water you may be able to stay afloat for quite a long time. You may even eventually make it to safety, but would you want to? Probably not.

I always enjoy seeing actual figures when I read peoples blogs. It’s more personal and relatable. And let’s face it it’s a natural thing for us to compare ourselves to others. This can actually be healthy in many ways. But also destructive if done for the wrong purpose. For the sake of this blog post, I’m sharing because I want to demonstrate what I would call rational exuberance and what that looks like. Use it as a benchmark for your own fanciful spending. Two rather large expenses I made in 2023 were purchasing a new car and going on a week cruise with Norwegian. The total car purchase out the door was $35,134.62 for a 2022 Camry XLE Hybrid with 15,344 miles. This was about $7,000 less than the brand new out the door figure I was getting from dealers in my area. And my cruise was $1,462.00. It should be noted that I financed 100% of the car. Reason being is despite having a 7 figure net worth I don’t keep much cash. But I do recognize with interest rates being what they are presently, the rationale for holding higher levels of cash is elevated. So I will make that adjustment going forward. That being said, I used a Line of Credit against a rental property with a teaser rate of 4.9% for 6 months to purchase the vehicle that is interest only in terms of my payment. So I have a payment of $185.92 that gets adjusted down with each payment made. So when I do my free cash flow statement each month I’m only factoring in what is required of me to pay. So the $185.92 for instance. And of course I fully expensed the entire cost of my cruise.

So where did that leave me financially?Through October of 2023, I have had a total free cash flow figure of $37,609.31 or for you monthly people, an average of $3,419.04. Keep in mind this is cash flow. I fully max out my 401k at work which is $22,500.00. But this comes out pre tax. So my free cash flow figures would be net of that. I also included in free cash flow the net income for my rental properties.

So essentially I was handed $37,609.31 to build my net worth the most intelligent way I could. What did I choose to do? Well, first I maxed out my Roth IRA. So deduct $6,500. Then I had a little debt on a HELOC from some roof replacements last year that I decided to pay off, so deduct another $10,467.00. The remainder of my free cash went to paying off the new car.

All in all, I allocated $31,000 (24,500 401k + 6,500 IRA) of retained earnings to stocks and $31,109.06 (roofs and new car) to paying off some debt. Not a bad year. And I still have a month of cash flow to go! Now, just imagine if my gap was negligible or god forbid negative. Then that car purchase would have been idiotic. Considering my situation it was not a big deal at all. This is perspective. And keeping spending and investing in the proper perspective is imperative to being financially successful.

Work Backwards let your mind wander to the future. Where would you like to be financially? Paid off house? 1 million in retirement accounts and debt free? Write it all down. Then calculate how much you need to put away each month. Work backwards. Based on your present levels of income and expenses are your goals achievable or so adjustments need to be made? If you don’t know your expenses to the penny it’s nearly impossible to plan for things like this. You are operating under the hope and prayer method.

Make More or Spend Less a cool thing about getting ahead financially is you can take many approaches. Remember, the secret sauce is your gap. The difference between what you bring in and what you spend. If you are a high earner bringing in 25k a month, and you keep your spending like you were a broke college student and you are saving and investing 22k a month or 264k a year, then you will get rich very fast assuming you do intelligent things with your gap. For me personally. I’m an average guy with average earning power and I would argue below average skills. So taking the high earner approach seemed like a reach. And I didn’t want to sit around wasting time, thinking well, if I don’t make a lot of money I can’t get ahead. Hell with that. Give yourself a raise by spending less. After all is said and done, your free cash flow is indifferent if it came from making more or spending less. It’s all the same. It’s free cash. Period.

Suppose you say to reach my goals I need to have $3,500 a month of gap. that’s 42k a year to pay off your debt and then invest. Over a period of time this will get you to your goals. Well you can sit around and wait for some huge income opportunity. And if it doesn’t come you use that as an excuse. Or, you can say ok, I’ll be a frugal badass, have a more efficient lifestyle and cut my expenses by $3,500. Your gap won’t know whether it came from more money or spending less. And I’m guessing your future self won’t care either. And an added benefit is you will have learned to get the same level of happiness on far less money. And if I’m honest, you will likely be happier as a result than you were before. Because now your gap has a purpose. It’s working for you. And that progress and growth takes on a happiness of its own.