Let’s face it. We all like to see how we stack up to those around us. It’s natural. It’s all part of the evolution of our species and a great way to learn and grow. There are some great things that can come from this. And also some bad. Depending on how the information is processed and used. If it leads to envy and jealousy it’s probably counter productive. If it leads to adjustments and change for the better, it can be highly productive.

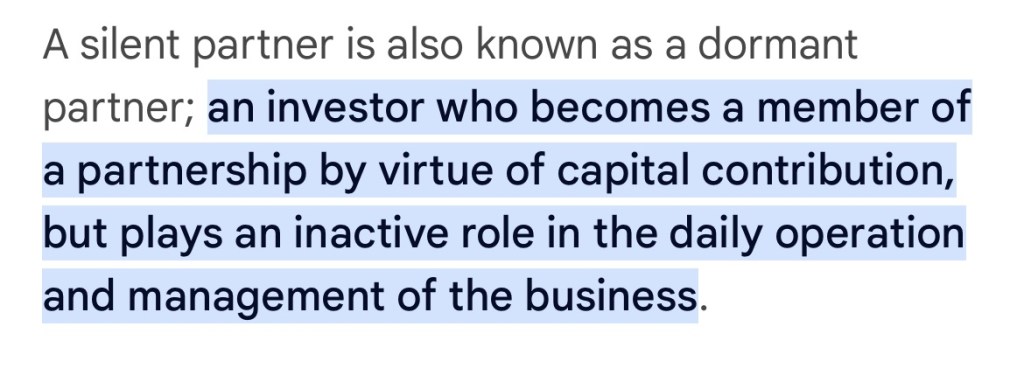

When the topic is personal finance, which are such a taboo subject like religion and politics, most people are left in the dark when it comes to any level of comparative analysis. I view this as a very negative thing. If people knew how far behind the averages they were, it could encourage them to make necessary adjustments to ensure their later years are not destined for poverty and a diminished quality of life. Unfortunately we have no idea where we stand usually. Nor do we even know a valuable metric to use as an instrument for said comparison.

I hear people say things all the time that lack context and or relevance. For example, a statement like “oh he’s rich he or she has 10 million of assets.” This lacks so many needed inputs to assess someone’s wealth. Like, gee um what are the liabilities maybe? Or how much do they spend annually? Quite feasibly you can have 10 million of assets with 9 million of debt, be spending more than you are bringing in annually and be on your way to bankruptcy. Real talk.

It would be so useful if we had sort of a universal wealth metric. So we all know where we stand. This could be so beneficial to those with low score to make the necessary improvements and for those with great score to be able to take their collective foot off the proverbial financial gas pedal and learn to enjoy what they have accumulated. So the score can benefit everyone. It’s all about context and perspective. Two eye opening and powerful words.

So, I have formulated a metric that I use personally called my wealth score. I use it to compare myself to others of course. But mostly I use it to ensure I don’t fool myself into thinking I’m doing better than I actually am. After all if you can’t be honest with yourself then well, you’re probably screwed. People fool themselves all the time. Without knowing or realizing it they tell themselves financial lies. They transfer money to a savings account month yet run cash flow deficits bc they don’t keep track of their total spending or they contribute to a 401k but spend more then they bring in, so their savings rate is actually negative. They are growing their assets but growing their debt even faster. These are all examples of the lies we tell ourselves when it comes to money. It should come as no surprise that people feel they are treading water financially. We need to keep score.

What we need is the best tool to see where we are. One that takes into account all the relevant metrics. Assets, liabilities and cash flow. But also a metric that strips out the unnecessary fluff metrics such as your primary residence and frequent flyer miles for example. We have to get to the brass tax of what you need to know. Without further ado, here it is:

net investable assets/total spending

If this number is above 25, I’d say you are entering the financially well off level of personal finance. So what does all this mean? As I usually do, I will use my own financials to illustrate the usefulness of this score a little later. I like to look at what could be used to invest to create passive income. Obviously, my primary house would do nothing, my frequent flyer miles or American Express points would do nothing either. Vehicles would also be excluded. Although if you had one or more “secondary” vehicles that could be sold and invested, this should be potentially counted. These are all great assets, and I count them on a balance sheet as such. But if I want to create passive income, they are useless. Hopefully the difference is clear. It’s an important distinction.

For me, for the net invested assets portion of this formula I count only the equity for investment real estate, net stocks which factor in lines of credit against them, and cash. All these assets are net invested capital. So for example if I had 350k of stocks and a line of credit borrowed against them of 50k, I’d factor 300k.

Next is the spending. This is the tricky part of this formula. As I’ve mentioned in prior posts, knowing your spending is incredibly useful, yet almost nobody does it. It’s tedious to keep track of. Years ago you’d have to have spreadsheets and keep receipts. These days it’s easier. You can simply link your accounts to software and it tracks it for you. I do both. I’m extra. If one fails I have backups. The important thing is to capture all your spending. Every penny. Not just your bills. How much does your life cost essentially. Notice that I don’t factor in any personal loans or credit card balances into this formula. These would be captured in a balance sheet of course. For the purpose of this wealth score however, it would be captured in your expenses in the sense of what you pay for your required statement bill. But only what’s required. Not any extra you choose to put towards servicing the debt.

This score is in my opinion the best at capturing your situation as it is. Only what’s necessary. Stripping out the rest. My score is 49

1,484,583 / 30,114.13=49.299

Not bad. my goal is to improve this figure going forward. Which means I have to essentially grow net assets much faster than I’m growing my spending or lifestyle. And that my friends is as they say, the brass tax of it. What is your wealth score? Happy holidays and happy calculating.